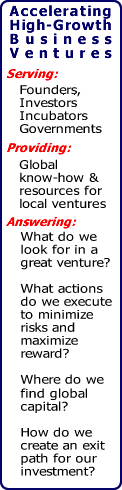

Technology Ventures Focus

Technology Ventures and Technological Entrepreneurship

Technology ventures, in competitive markets, differ from other business ventures in that they unfold at the frontier of the established human experience. Technology ventures, as a class, exploit product opportunities derived from scientific and technological advances. They entail high levels of uncertainty, tend to be short lived; and either quickly fail; become part of larger businesses or become publicly traded companies in the rare event they can sustain unusually high rates of sales growth.

Technology ventures require large and rapidly increasing amounts of capital since they execute their business plans at breathtaking pace. The processes leading to a hyper-growth venture have evolution time measured in weeks rather than quarters. The entire high growth entrepreneurial process is a race against time in which conventional business processes are vastly ignored in exchange for speed and growth.

Technology ventures are funded by highly specialized pools of capital; mainly “Angel” Investors and professional Venture Capital money managers. Angel Investors are most often successful entrepreneurs from past recent ventures. Venture Capitalist are private equity managers of funds designed to deploy capital using small and narrowly focused portfolios of potentially high growth companies; carefully selected for having technology base and business models designed to deliver payoffs or distributions to its investors in less than 10 years in order to take advantage of reduced tax rates on venture class capital gains.

Clearly, technology ventures are unique and complex in many ways. Management team experience can improve the odds significantly, and is critical in those ventures lacking an unfair technological advantage for over its rivals.

Fortunately the processes supporting the development of technology ventures are more or less mature and well understood in certain pioneering regions of the world, such as Silicon Valley in California; Route 128 in Massachusetts; and San Diego in California, to name a few.

Novatempo has been since 2001 studying and documenting common characteristics that make certain regions of the world and certain technology ventures uniquely suited to deliver growth and success to entrepreneurs, investors and regions.

Novatempo transfers this knowledge into emerging technology regions of the planet through workshops, consulting and coaching.